There’s much happening in the precious metals’ industry. On the surface, if you believe the hype spewed by the main stream media, you might be mistakenly led to believe that both gold and silver are very poor investment properties at the moment. There are a couple of realities that a new investor, or experienced “timid/careful” investor needs to consider before believing the current highly-propagandized notion that you’re wasting your money on gold and silver holdings: Gold and silver have been, on average, the most valuable tangibles available since we stopped using grain and livestock as the foundation of our monetary

Continue reading…

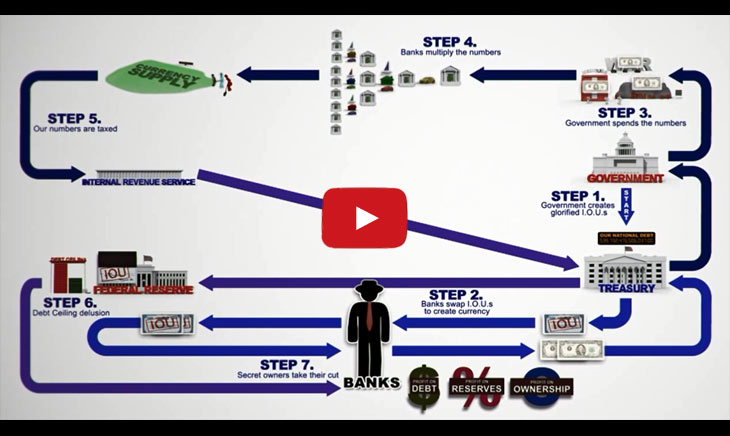

Must Watch: The Biggest Scam in the History of Mankind

Silver investing is on the roll right now, and there seems to be enough articles and news pieces to read about the prospects of investing in silver over gold. Of course, gold IS money; but silver is so undervalued right now (around 60:1 against gold, way below the all-time average of 12:1) that it makes a great investment. To me, the whole idea about silver investing is to buy silver and when the silver-to-gold ratio approaches the all-time average, turn it into gold. When you have made your decision to invest more in silver, the next question is most likely

Continue reading…

For the newbie investor, where to invest your money is a tough call. There’s more to investing than simply throwing your extra cash into something that looks good. So that means you need to consult an “expert” right? Get someone, like an investment advisor, with all the cold hard facts to tell you what to do with your kids’ college fund. Not always the best choice. Not all “experts” worth being called experts. There are some legitimate experts you need to follow: Robert Kiyosaki, Warren Buffett, and many other authoritative figures in wealth building. Even some people don’t like them

Continue reading…

If you’re in the market for a hot investment, and have some disposable income that you don’t need to have immediate access to right now, then you’re about to get in on a super-huge, massive tip that’ll have stupendously-positive repercussions in the coming years for your financial portfolio! So what’s the deal with silver you’re saying? The silver standard ended in the latter half of the last century. Where’s the demand? Jewelry? There is a demand, just not for the things you’d normally associate silver with… There’s a lot of really good data that makes this commodity more than just

Continue reading…

We’ve all heard about the long-term asset building potential of gold. Silver is unpredictable and very tempestuous in the short-term, but in the end it will always retain its value; particularly with its endless uses in industry and all the modern technology that runs on electricity. So, either of these precious metals is a sure-fire investment, right? Yes and no… If you’re working with the right advisors and not getting pulled into one of the many “if it looks to good to be true, it probably is” opportunities that proliferate like rabbits day by day. Due-diligence is key and it’s

Continue reading…