Why You Need to Invest in Cash Flow Positive Real Estate

Ah, to own that crown prince of a property in the wealthiest part of town. That is the American dream isn’t it? Put up that massive chunk of cash you’ve been saving for the last ten years as a down payment, so you get the best mortgage rates, and dive right in right?

That’s not why you’re here though. You want to achieve another part of the American dream. One where you’re financially secure, maybe with a Porsche or Lamborghini parked in the drive, and an Island in the South Pacific that you own outright.

You’re an investor looking to “buy em and rent em”, or “rip em and flip em”, right?

Even if your investment dreams are less extravagant, you need to invest in cash flow positive real estate that (hopefully) won’t leave you holding the bag when times get tough. No investment is ever secure, and the ceiling on the housing market is usually the first to cave during an economic downturn.

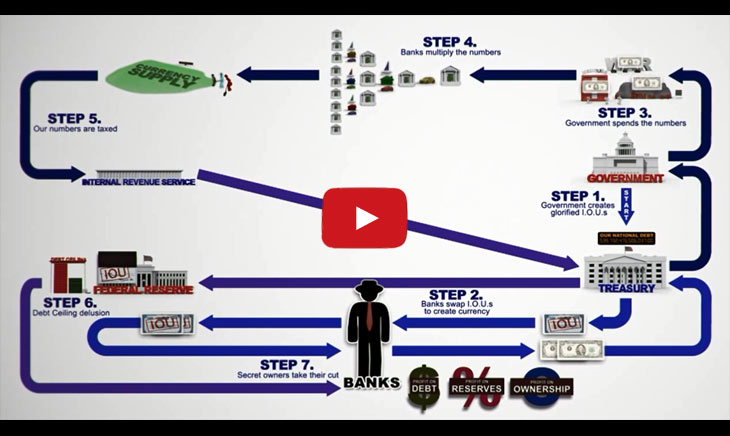

Just watch the Youtube video at the bottom of this page. It’s truly heartbreaking and shows what happens when you own a negative cash flow property and everything goes south on you.

Negative cash flow properties = Broken dreams and headaches

So, the answer as to why you need to invest in positive cash flow properties is simple: so you make money instead of losing it.

Heck, everyone you know is talking about how much their house is worth. Sorry to be the bearer of bad news, my friend, but if you’re not renting your properties (with a positive cash return every month), it’s not cash flow positive and in fact is a liability in your portfolio. When the market turns downward, values go down. A home that was worth 500-grand can plummet to under 200 in the blink of an eye.

Rent, however, doesn’t go down in a poor economy. At least not on most practical properties, such as apartment complexes and modest family-sized homes. Let’s just say that owning a cash flow positive rental property is a hedge to the inflation and uncertain economic situation.

What constitutes a negative cash flow property?

When you own something with a negative cash flow value, it means that more money is going out than coming in. This is how you don’t get rich, by the way. Don’t make hasty deals without due diligence, including basic equations like:

Acquisition cost + all expenses – net income = total cash flow

Defining “investment”

Accountants and bankers let you claim your house as an asset, but if it isn’t putting money in your pocket it’s a liability. Pure and simple.

This is no different from if you were to buy a vintage car, with plans to restore it and sell it. You have to put money into that car in order to sell it, meaning that it’s going to cost you until the day when you eventually make the sale. It’s an investment, yes, but also a liability until you sell it.

If you’re a landlord (or want to be one) looking to invest in a property, here’s an amazing resource that details nearly every single cash flow projection and risk calculation you’ll need to make before investing in real estate:

http://www.milliondollarjourney.com/landlord-math-cap-rate-and-return-on-investment.htm

The endgame is to charge more rent than you pay in mortgage – carefully using the link above to make sure all your bases are covered such as a burst pipe, broken water heater, property tax increases, weather damage, vandalism by your tenants, etc.

Incidentally, you need to screen incoming tenants just as carefully as the property itself, to make sure they too will be cash flow positive rather than a liability to you!

With all foreseeable liabilities in check, you can invest small chunks here and there to build equity and value in the home, and watch the market for the perfect time to sell it for a huge profit. Or simply keep paying the mortgage, collecting your profit and building mortgage equity you can use to buy other properties.

Takeaway

- You’re investing, not buying a dream home to settle into for the next 40 years.

- If you’re spending more money than you make that investment isn’t cash flow positive.

- By that reasoning, a flip isn’t cash flow positive until the home is sold. There’s more risk involved in this type of investment.

- A banker lets you claim the house as an asset. If you’re only spending money (living in it or renovating) and not making it (renting), you don’t have the luxury of calling it an asset.

- Due diligence is key to purchasing cash flow positive homes.

Check out this video if you feel the house you live in currently is a burgening investment:

Further Reading:

www.forbes.com/sites/zillow/2013/05/21/three-things-that-make-a-great-real-estate-investment/

www.foxbusiness.com/personal-finance/2013/07/01/real-estate-investing-why-cash-flow-is-king/

www.zillow.com/blog/2011-10-25/smart-investing-a-tale-of-two-townhomes/

Photo credit: interpunct