Precious Metals: Are You Being Deceived?

There’s much happening in the precious metals’ industry. On the surface, if you believe the hype spewed by the main stream media, you might be mistakenly led to believe that both gold and silver are very poor investment properties at the moment.

There are a couple of realities that a new investor, or experienced “timid/careful” investor needs to consider before believing the current highly-propagandized notion that you’re wasting your money on gold and silver holdings:

- Gold and silver have been, on average, the most valuable tangibles available since we stopped using grain and livestock as the foundation of our monetary system. Of course, that changed back in the 70’s when the US Government changed the face of money worldwide by introducing the concept of fiat money, which made intangible money the global standard. Fiat money has nothing concrete behind it. Nothing that people need or want, other than the notion of intrinsic value. If/when foreign interests and/or the American public lose faith in it, both you and I are in the crapper if all we have is a bank account with “dollars” in it.

- The main stream media (often referred to as the “MSM”) tightly controls the flow of information. The little guy really is at the mercy of those who hold the bigger interests. Knowledge is power, but we’re often nothing more than mice running around in a maze when it comes to being told what to (or not to) buy. It seems that the big guns are trying to put the sad face on market sentiment related to gold and silver investments currently – telling us that gold and silver are poised for a decline (see this article). In fact, a smart investor knows gold, silver and most other precious metals (i.e., tangible assets) will always be valuable.

In fact, there’s only one real universal concern a gold/silver investor needs to worry about:

“Fugazi” Concerns

As an investor, we have to be conscious of the fact that counterfeiting exists in this industry.

So there’s always a chance that trading your dollars for a gold/silver holdings could result in a bad investment, if your dealer gets duped. Always make sure your investments are insured.

The same holds true for coin and jewelry purchases.

Gold and silver-plated tungsten is always a threat and you have to know how to spot a fake, especially when buying privately – even when buying from a respected jeweler (learn more here).

The Deception

Steve Rocco (srsroccoreport.com) recently opened up a whole can of worms on the precious metal mining industry. Criticizing silver miners of understating their true production costs. He bases this off some very simple math, that includes obvious dramatic overhead cost increases (see: fuel costs over 10 years) that have been being going up and up for the last ten years.

“With the current low price of gold and silver, including all the negative press coming from MSM, many precious metals investors are increasingly frustrated and concerned about their metal investments.

One of the major problems as I see it, is the confusion on the real cost of mining gold and silver. If investors believe it only costs $7-$10 to produce an ounce of silver, they will have less faith in a $20 silver price holding. To them, the market price of silver could fall to $10-$15, just as the analysts at Natixis stated in article linked above.

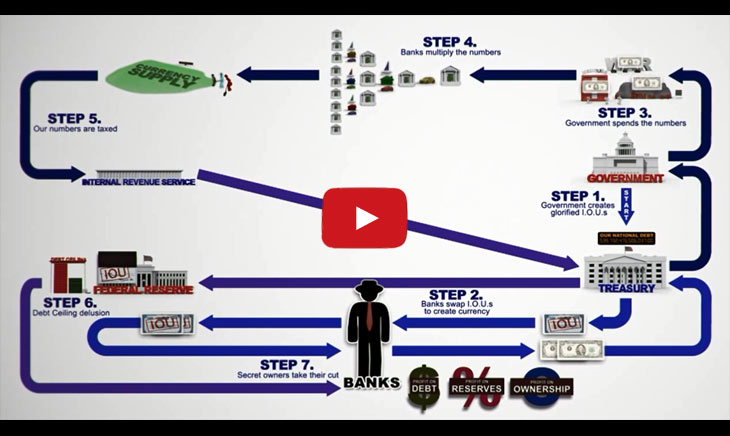

Of course, these Natixis analysts work for a French Global Financial company that makes excellent profits from the highly inflated fiat monetary system. So, it’s in the best interest for these institutions to keep investors believing that gold & silver are low price garbage assets not worthy of anyone’s time, while the real profits are made in the Grand Financial Ponzi Scheme.” (source)

In the underlined portion of the quote shown above, Rocco cautions us all to be wary of anything the big investment banks are trying to feed us. The “Grand Financial Ponzi Scheme” he’s referring to is the fiat-money-system.

Rocco goes even further, laying out how higher energy costs make for higher mining costs (well duh!)

Since energy costs (in the case of miners, diesel fuel) are 4x higher than they were back in the late nineties, Rocco’s math shows the true current cost-per-ounce to be in the neighborhood of $24, not the $7-8 quoted by Natixis.

Bad Investment or “Smart Investment”

Check out the following Forbes piece from a couple of years ago (seems this may be coming to light sooner rather than later):

forbes.com/sites/charleskadlec/2012/02/06/the-federal-reserves-explicit-goal-devalue-the-dollar-33/

Also, China’s buying up gold like gangbusters. It’s obvious they want to overthrow the USD as the reserve currency. China and Russia are making moves toward a global gold-backed currency. And, Russia’s the current largest crude exporter. Which, as you’ve just learned, is an essential part of the gold/silver mining process.

occupycorporatism.com/china-calls-new-world-order-death-us-dollar

Let me trim the fat for those of you who just want the plain facts:

If you understand the historical value of our two most precious metals, then none of what I’ve stated should be a reason to NOT invest in gold or silver, but rather a good reason to start moving your inflationary dollars into both.

Gold will always be the unofficial standard for money, long after the last gallon of “liquid gold” is gone. How about Silver? Well, I believe that it is still way undervalued (you need 60 oz. of silver to buy 1 oz. of gold – historical average: 12 to 1.)

Unless we return to purely living off the land, abandoning our electronics, silver is irreplaceable. It’s heat dispersing properties are invaluable in all electronic applications.

Remember that THIS could happen to anybody. Paper money only means something so long as the collective agrees it does.

Photo credit: EpSos.de